The way you handle money on a daily basis lays the foundation for your future, so every little decision matters. Saving and investing are two sides of the same coin, but people often get confused between them. Many struggle to plan financially because they live in constant worry, do not have direction, or lack guidance. However, you will be amazed by how little changes can lead to great financial improvement. This article introduces you to four practical tips that can help you spend smart and make wiser investments. These tips will not only help you get out of financial stress, but also build а long-term, secure future.

- Know Where Your Money Goes

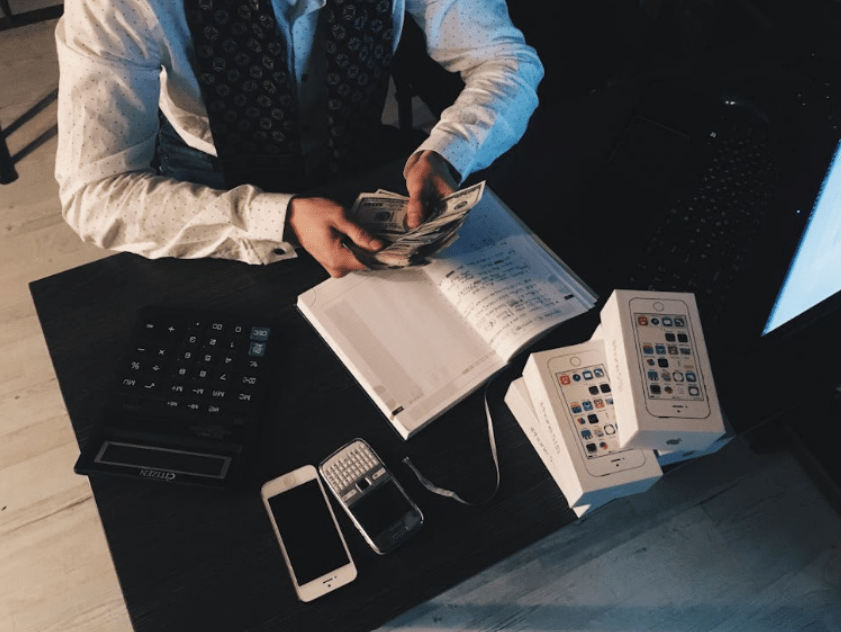

Get control over your money by tracking every cent and where it goes. Spending leaks like coffee stops and impulse buying can throw your budget off track. Decide on what you really need and what you merely want, so that your hard-earned money doesn’t get wasted. A simple notebook or an easy budgeting app can help keep your spending in check. With this habit, you will also be able to see your pattern and areas where you can save. Setting limits on non-essential stuff will allow you to spend smartly and help you to and focus on what truly matters. Knowing where your money goes will provide you more power over it, and you will be able to change your financial future with clear awareness.

- Build Better Saving Habits

Saving does not entail drastic cuts; it is all about being consistent. Begin with small amounts you won’t miss and then increase as you get used to it. Make a goal behind your savings, be it a holiday, a car, or an emergency fund. Use technology to simplify your savings with automatic transfers, so that you do not forget to save. Protect your savings by being mindful of daily expenses and avoiding unnecessary lifestyle upgrades. Celebrating small successes will make the saving process enjoyable. When you build better saving habits, it will let you accumulate the funds needed to take advantage of larger financial opportunities in life or in case an emergency comes up.

- Make Your Money Work for You

Good spending is not sufficient; you should let your money do the hard work for you. Passive income streams, such as rental properties or dividend stocks, come in very handy in this case. Reinvest your profits, and they will compound over time. Avoid putting all your money in а single place. You can diversify across accounts, investments, and financial tools. Understanding your financial situation puts you in а strong position to adopt a proactive strategy. Remember that smart investing is actually a game of patience; allow your assets to mature in due course.

- Get the Right Advice Before You Invest

Consider getting some knowledge before you enter the investing world, and an experienced financial advisor will be able to assist you with this. Educational sessions will help you understand the different kinds of investments and how they can assist you in reaching your specific goals. Get the information regarding investment risks and understand your own risk tolerance. Talking to experienced investors, even just for а short chat, can give you а better idea of what to expect and what to avoid. For instance, а financial advisor in Nevada not only provides general investment advice, but can also tailor recommendations based on the state’s specific tax laws, real estate trends, and economic landscape. The money you earn must be put where it stands a good chance to grow and multiply, and being informed gives you a big advantage.

Conclusion

Your daily money habits are the key to your financial health and future. Smart spending enables you to stop living from paycheck to paycheck and brings peace of mind. Making wise investment decisions after doing the right things ensures that you have something solid to fall back on later. Always remember that it’s okay to seek assistance. There are professionals ready to guide you toward financial relief and success. Whenever you are pressed for time, make small changes, as even a small change will have a massive impact in the future. It is never too early to be in charge of your monetary future.

Sources

https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/ways-to-save-money

https://www.emiratesislamic.ae/en/key-information/financial-literacy/smart-money-habits

https://www.powerfi.org/Blog/2025/February/How-to-Be-a-Smart-Spender-Tips-for-Spending-Wisely

https://www.investopedia.com/articles/00/082100.asp

https://www.experian.com/blogs/ask-experian/tips-for-spending-money-wisely