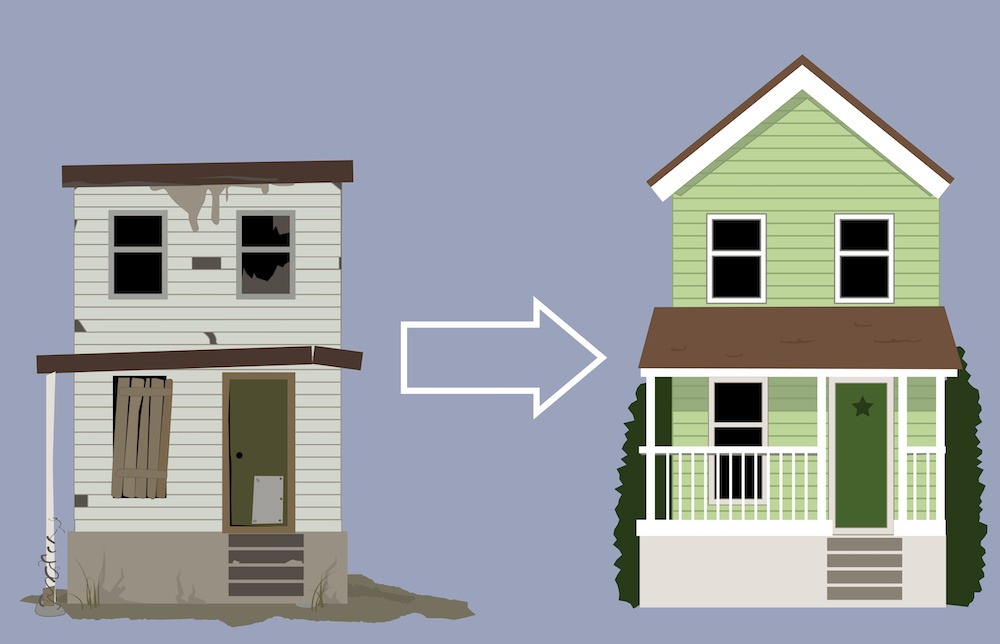

The real estate sector can be a challenging one to navigate. However, for savvy entrepreneurs, knowing how to successfully flip a property isn’t only exciting, but can also become a highly profitable business model.

If you’re someone who’s able to see past subtle (and not so subtle) imperfections and find real diamonds in the rough, you could successfully turn a hobby into a successful venture. However, property flipping comes with a lot of financial risk if you’re not careful.

By following the strategies below, you’ll make sure you’re making more tactical decisions surrounding the properties you decide to flip and applying the right strategies to extract the most value from each project you take on.

Make Sure to Find a Suitable Location

Finding an ideal solution to source older properties on the market or quick sale opportunities is critical to make sure you’re investing in the right place. You really want to think about your target customer base and the preferences they’re likely to have when purchasing a home.

Some of the considerations you should be making are whether or not the home is close to reputable schools and how the neighborhood feels. You should also think about local amenities that might be available, such as nearby parks or malls, since these are common features home buyers consider before committing to a property.

Know Your Potential ROI Before You Commit

Before you even start looking for a property, it’s first important to consider your budget and what you’ll need in order to turn a profit. You want to make sure that any property you invest in will give you the necessary ROI to make it worth your time and resources.

A great place to start when doing this type of analysis is factoring in your After Repair Value (ARV). This is the figure that will tell you, after all your property renovations are finished, how much you’ll actually expect to make for all the work done.

Making sure your ARV is as accurate as possible will go a long way in ensuring you’re able to list the property for an ideal amount without losing any money on the project. When you calculate this figure, however, you want to make sure you’re not missing any details.

Consider the initial purchase price you pay for the property, all your renovation expenses, and any holding costs. All of these elements will eat into your profits and should be closely considered even before you buy the property.

Look Into All Your Financing Options

The amount of funding you’re able to secure will also control your ability to turn a successful profit when flipping properties. This is why it’s important to weigh all the options you have available to you.

For example, most property flippers will use conventional mortgage loans since they have attractive interest rates. The challenge with this format is that you’ll often need a substantial down payment before you’re able to secure the loan. This can be a challenge for new property flippers who don’t have a large amount of capital on hand.

Another option you might want to explore is reaching out to private investors. These partners can help you gain faster access to funds, although you’ll more than likely be on the hook for higher interest payments or even a share of your business’s profits.

Never Skip the Inspection

One of the largest mistakes you can make as a property flipper is to make a purchase on “gut feel,” without doing a proper inspection of the home. This is common in “site unseen” property auctions. While you might get lucky and won’t have to deal with too many issues once you start your home renovation projects, in many cases, there can be significant problems that can cost you significantly down the road.

Home inspections are vital, especially when considering older homes that likely have foundational issues or outdated plumbing or electrical systems. While these inspections require an upfront investment and can add time to flip, they can prove to be invaluable to your business.

Choice Renovations With Higher Perceived Value

An important element of ensuring a successful home flip is to make the right renovation choices. It’s important to remember, though, that not all home renovations you’re considering may be the right ones to make.

Even though every improvement adds a certain level of value to the property, this doesn’t mean you’ll see a consistent dollar-for-dollar value add. This is especially the case when renovating older homes, where a single renovation project can often add additional unforeseen expenses that weren’t originally budgeted for.

There are, however, some effective ways to add more value to the upgrades you make. For example, looking through discount warehouses, salvage yards, or various online retailers can help you save on multiple renovation materials. This can help you achieve a better return on investment (ROI) when upgrading common areas, bathrooms, and kitchens.

Establish a Reliable Team

There are several key factors that must align when attempting to make a successful property flip. You not only need to make sound financial decisions along the way, but you need to make sure you have a reliable team of contractors, suppliers, and workers you can count on to get your projects finished on time and within budget.

This is why it’s essential to take the time to source high-quality professionals with whom you can work well and who you can rely on in a pinch. Building a large network of individuals who can get involved in your projects will ensure you receive consistent quality work and complete renovations quickly and efficiently, allowing you to flip the property and move on to the next project.

Make Your Next Property Flip a Success

If you’ve already started your first property flip project or are considering jumping into the real estate pool, you want to make sure you’re following these best practices listed to ensure you can maximize your profits while setting yourself up for long-term business success.

Author Information

Author Name: Michael Alladawi

Author Bio:

Michael Alladawi, CEO & Founder of Revive Real Estate, is a Southern California real estate veteran with a proven track record as a builder, investor, and respected home flipper. Michael created Revive Real Estate to share his industry knowledge and help homeowners maximize their profits when selling their homes. Michael’s passion for his work is as big as his desire to create lasting partnerships. For Michael, it all comes down to how much value one offers, both in business and life relationships.